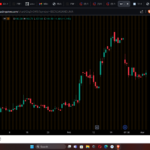

Cryptocurrency has emerged as one of the most exciting and volatile investment opportunities in recent years. While Bitcoin and Ethereum dominate the market, many new cryptocurrencies are gaining traction. These lesser-known digital assets could potentially offer high returns but require a strategic approach to identify and evaluate.

If you’re new to cryptocurrency, it’s important to understand that investing in this space is different from traditional markets. The lack of regulated evaluation metrics, coupled with numerous scams, means you need to be cautious and informed. This guide will walk you through the essential steps to find new cryptocurrencies and evaluate their potential.

Key Takeaways

- Cryptocurrencies provide diversification and can potentially deliver high returns due to their price volatility.

- To identify new cryptocurrencies, use platforms like exchanges, data aggregators, social media, and specialized tools.

- Evaluate a cryptocurrency’s use cases, liquidity, value, and prospects before investing.

Where to Discover New Cryptocurrencies

Finding promising new cryptocurrencies requires exploring various sources and tools:

1. Cryptocurrency Exchanges

Cryptocurrency exchanges like Binance, Coinbase, and Kraken regularly list new cryptocurrencies. These platforms are one of the most reliable sources for discovering new investment opportunities. By setting up an account, you can access detailed information about listed coins, including trading volumes and market caps.

2. Data Aggregators

Data aggregators like CoinMarketCap and CoinGecko collect and display valuable data on emerging cryptocurrencies. These platforms provide price trends, market capitalization, and trading volumes, offering a snapshot of how other investors view a particular coin.

Pro Tip: Always cross-reference data from aggregators with real-time information from trading platforms to avoid inaccuracies due to network delays.

3. Social Media Platforms

Social media channels such as X (formerly Twitter), Telegram, and Discord are hotspots for the latest cryptocurrency updates. Developers and communities often share announcements about new coins, partnerships, or project milestones. Setting up alerts for keywords like “new crypto” or “crypto release” can help you stay updated.

4. Specialized Tools

Tools like KryptView, BSCCheck, and TokenSniffer are invaluable for verifying the legitimacy of a cryptocurrency. For example, TokenSniffer provides detailed audits, contract analyses, and liquidity checks, helping you avoid potential scams.

5. NFT Marketplaces

Platforms like OpenSea and Rarible are excellent for discovering new non-fungible tokens (NFTs). NFTs represent unique digital assets and often come with high growth potential, especially in emerging tech trends like the metaverse.

6. Initial Coin Offerings (ICOs)

ICOs are fundraising events for launching new cryptocurrencies. Though highly regulated and less common now, ICOs can still be a gateway to promising projects. Ensure that any ICO you invest in complies with regulatory guidelines.

Evaluating Cryptocurrencies: Key Factors

Once you identify a potential cryptocurrency, evaluate it thoroughly to assess its long-term viability:

1. Use Cases

A cryptocurrency’s utility is one of its most important attributes. For example:

- Ethereum (ETH): Serves as a payment system on its blockchain and powers decentralized applications (dApps).

- Bitcoin (BTC): Primarily used as a payment method and a store of value.

The more use cases a cryptocurrency has, the better its chances of sustained growth.

2. Liquidity

Liquidity determines how easily you can buy or sell a cryptocurrency. Coins with high trading volumes are generally more liquid and less risky. Conversely, low liquidity might indicate a lack of investor interest or potential scam activity.

3. Value

Evaluate both the tangible and intangible value of a cryptocurrency. For instance, NFTs often have emotional or artistic value that can appeal to specific investor groups. Meanwhile, tokens offering real-world solutions tend to gain traction more quickly.

4. Prospects

Analyze whether the cryptocurrency solves a real-world problem or has a competitive edge. Projects offering innovative solutions or significant technological advancements often have better growth prospects.

5. Supply and Demand

Check the maximum supply and the token’s current demand. Cryptocurrencies with a fixed supply (e.g., Bitcoin) can become more valuable as demand increases over time.

Common Scams to Watch Out For

In the cryptocurrency market, scams like rug pulls are prevalent. Developers may launch a coin, accept payments, and then disappear, leaving investors with worthless tokens. Use tools like TokenSniffer to identify potential red flags, such as:

- Concentrated ownership in a few wallets.

- Insufficient liquidity.

- Similarities to previously flagged tokens.

Top Cryptocurrencies to Watch

While many new coins emerge daily, it’s wise to keep an eye on established cryptocurrencies with proven track records, such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- BNB (BNB)

- Solana (SOL)

These coins are not only widely recognized but also benefit from strong developer and community support.

The Bottom Line

Investing in cryptocurrencies can be rewarding but requires careful research and evaluation. Use reliable sources to discover new coins, and take the time to analyze their utility, liquidity, and prospects. Always remain cautious and consult a financial professional to ensure your investments align with your financial goals and risk tolerance.

By following this guide, you can navigate the complex cryptocurrency landscape with greater confidence and identify opportunities that match your investment strategy.